Why Military Members Should Buy and Hold Real Estate

Military members are in a very unique position in terms of their ability to purchase real estate. The VA loan is one of the most powerful tools that any investor can take advantage of. Any way that someone can get into a property with zero money down is incredibly powerful and can be especially lucrative. Military members have access to this automatically without having to do anything. Furthermore, banks and lenders love the military community because of the guaranteed paycheck, and the stability and security of their occupation.

There are so many ways to make money in real estate. Every year that you own a property, it appreciates. The value might dip here and there, but real estate has appreciated at 3% across the globe, year by year. Furthermore, when you are ready to move out of the house, you can rent it out and collect monthly cash flow. The average monthly cash flow for a property is around $300 a month. But if you replicate this even a few times, that money can become significant.

You also get paid in real estate as your tenant is paying down your loan. As your loan amortizes every month, more of the principal is being paid and your equity is also growing.

Lastly, there are significant tax benefits that landlords and owners of real estate can take advantage of including write-offs and depreciation. For all of these reasons, it’s very critical that military members at least consider property ownership. Let’s look at a scenario of how renting compares to owning over a 15 year period.

S c e n a r i o

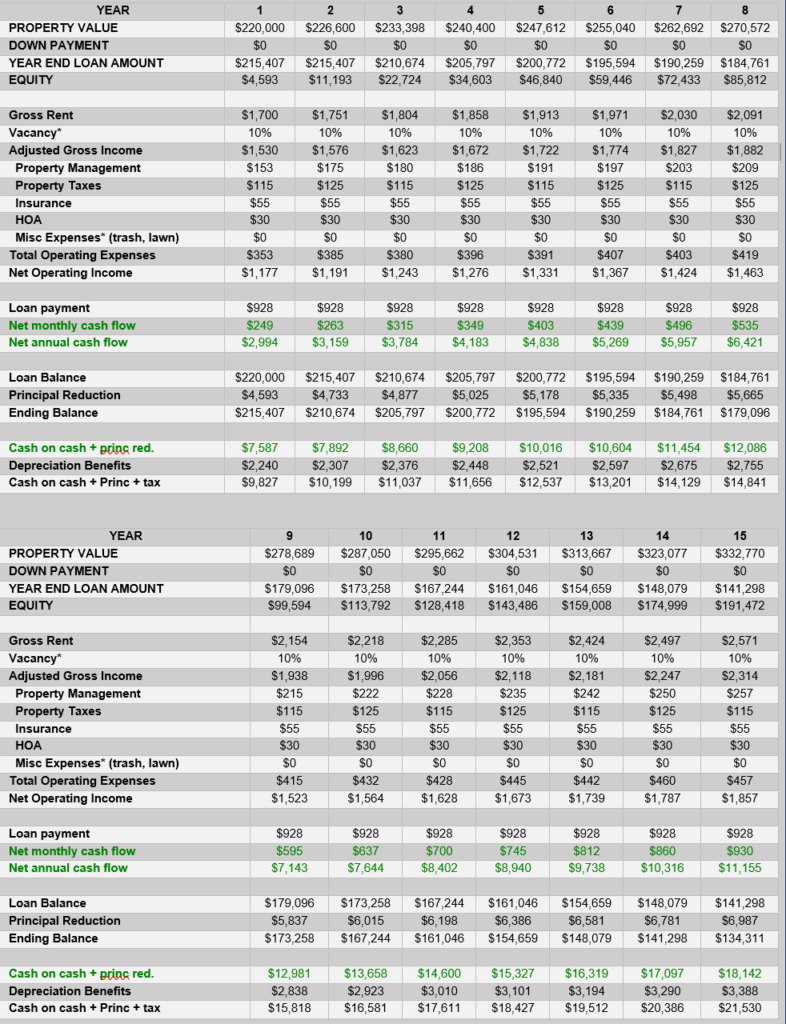

Let’s run a scenario on a property that I own. I’m intimately familiar with these numbers and I really want to show you the power behind it. This particular property is located outside of Fort Campbell in Clarksville, Tennessee. It cost $220,000 when I bought it. Using the VA loan, you could get into this property with zero money down. Current interest rates are super low, around 3%. So your monthly principal and interest payment, in this case, would be $927.50 total. That’s a 30-year term with 12 payments per year.

See the graphic below for the monthly expenses and returns; this particular property brings in $1,700 a month. I always like to give a 10% vacancy allowance, although this one has not been vacant for a single day. Insurance costs $55 a month; property taxes are $115 a month. There is an HOA fee, which is $30 which covers trash pickup. And then I currently pay a 7% management fee because I have a portfolio in the area, but the typical rate would be 10%, which is $153.

So total expenses on this property are $370. Take that gross operating income, which is $1,530; subtract those expenses, $353, and you’re left with $1,177 in net operating income.

Notice that the repairs and maintenance are zero for the first year. Since this is a new construction property, it had a builders warranty. Tennessee requires a builders warranty for at least year one, and other states have similar rules and regulations so always look for that warranty for security and to protect your cash flow.

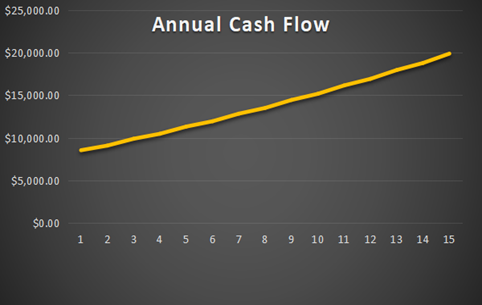

Now you have that $1,177 in net operating income, you pay the mortgage payment which is $927.53 and you’re left with $249 each month. Annually, this adds up to $2,994. This is cash in your pocket. But that’s only one part of the story and doesn’t even cover the true power of real estate.

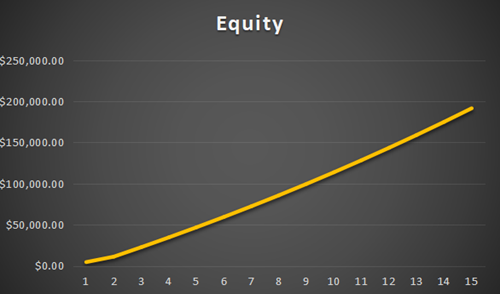

The value for this property was $220,000 when I bought it. For this scenario, we’re going to use the VA loan and put $0 down. In year one, you’re going to pay down the mortgage $4,593. Your loan amount is going down and your equity is going up. Also, notice how the rent increases every year, just as the value of the home increases. This is simply based on inflation and market appreciation, automatically making your cash flow increase because your mortgage payment never changes! In year one, your rent is $1,700, but in year 15, your rent is $2,571. So in year 15, your monthly cash flow is significantly higher and your equity has also vastly increased. The property value is also going up 3% a year, in year 15 it’s worth $332,770.You now only owe $141,298 on the loan, and you have equity in the amount of $191,472, and this is simply because you’ve owned the property. This is automatically happening over time and your net worth is literally growing while you sleep!

So that’s after 15 years. Let’s pretend you have the luxury of living in this house for 15 years. So let’s just say you paid this rent for 15 years, $1,700 in rent, that’s $25,500 that you would basically be throwing away. You would be paying someone else’s mortgage.

Look at the swing here: you could have gained $191,000 worth of equity rather than throwing $25,500 in rent away. That difference between your $191,000 gain and your $25,000 loss is $216,000.

Hopefully, that paints a really good picture as to why you should purchase a property while you’re still in the military. And if you replicate this and repeat a few times over a career, this can be incredibly powerful.

Now that you’ve seen the power of real estate played out in a real-life scenario, it’s important to note that home ownership is not for everyone! You need to look at the whole picture, the good and the bad, before deciding to purchase real estate.

PROS

- Real Estate is simple and easily learned.

- You can improve your assets.

- Real Estate is the only asset that reacts proportionately with inflation.

- Real Estate can be financed and leveraged!

- Inefficient markets mean a potential for very high profits.

CONS

- High transaction costs.

- Low liquidity.

- Maintenance and Management.

- Financial and Legal Liability.

- Inefficient markets increase the risk

[…] military house hacking is even more incredible because you can use your VA loan, and get into these houses for zero down. […]